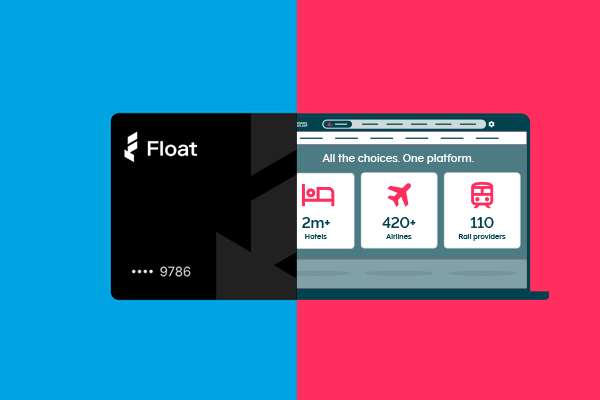

Corporate Traveller and Float Financial Partner to Simplify Business Travel Expenses for Canadian Companies

Book travel, capture spend, and control costs—all in one place, in real time.

TORONTO – September 24, 2025 – With SMEs poised to benefit from new federal investments, Corporate Traveller and Float Financial have partnered on an integration that simplifies one of the costliest challenges for growing businesses: managing travel payments and expenses. By automating the process—from booking to reconciliation to reporting—the solution gives finance teams real-time visibility and control over travel spend. According to a recent Corporate Traveller survey conducted by YouGov, 40 per cent* of Canadian SMEs are spending more on business travel this year, underscoring the need for smarter solutions that save time, support compliance and reduce costs.

When employees book flights, hotels or car rentals through Corporate Traveller and pay with a Float card, booking and payment details are automatically matched. Expenses are coded and pushed directly into the company’s finance system—no receipts or manual reconciliation. For travellers, that means fewer expense reports; for travel managers, cleaner reporting; and for finance teams, a faster month-end close.

Business travel demand is growing and so is the pressure on finance teams to track spend accurately and efficiently,” says Chris Lynes, Managing Director at Flight Centre Travel Group, parent company of Corporate Traveller. “Now, with the integration of Float, we're delivering a uniquely Canadian, modern solution that combines seamless booking with automated payment and expense management.

As someone often on the road for work, I know how much time gets wasted managing travel expenses. This partnership gives that time back to both Canadian employees and businesses by automating everything from booking to reconciliation,” says Andrew Dale, COO of Float. “It’s part of our broader vision to fully automate transactions across our platform and save companies thousands of hours.

The Benefits

- All-in-One Simplicity: Travel booked through Corporate Traveller and paid on Float cards is automatically tracked and reconciled in one place.

- Reduced Admin: Finance teams save hours as expenses flow directly into company systems.

- Better Oversight: Real-time reporting integrates with accounting software like QuickBooks, Xero and NetSuite.

- Made in Canada: Available in both English and French, it’s aligned with Canadian systems and regulations.

As mobile-first generations reshape the workforce, businesses are demanding smarter, more tech-forward solutions. Together, Corporate Traveller and Float Financial are setting a new standard for business travel management in Canada.

Simplify travel & expenses with Melon + Float

*Figures are from a survey conducted by YouGov Plc on behalf of Corporate Traveller Canada. The total sample size was 1,012 Canadian SME workers aged 18 and older who travel for business at least once a year. Fieldwork was carried out online between December 25, 2024 - January 5, 2025.